PRL Online Resources, Documents, and Dates

Online Resource Links

- Valuation and Tax Information

- This site is where you will find property and tax information about your property as well as the ability to print copies of your Tax and Valuation Notices.

- Online Recorded Documents(LandShark)

eNoticesOnline

Receive your property related notices electronically via eNoticesOnline.

eNoticesOnline is a service provided by our print vendor, "The Master's Touch, LLC", that offers residents of Olmsted County a paperless and green way to receive tax statements and valuation notices.

Is there a cost associated with this?

No. eNoticesOnline is free! All you have to do is sign up at eNoticesOnline.com.

How do I sign up for eNoticesOnline?

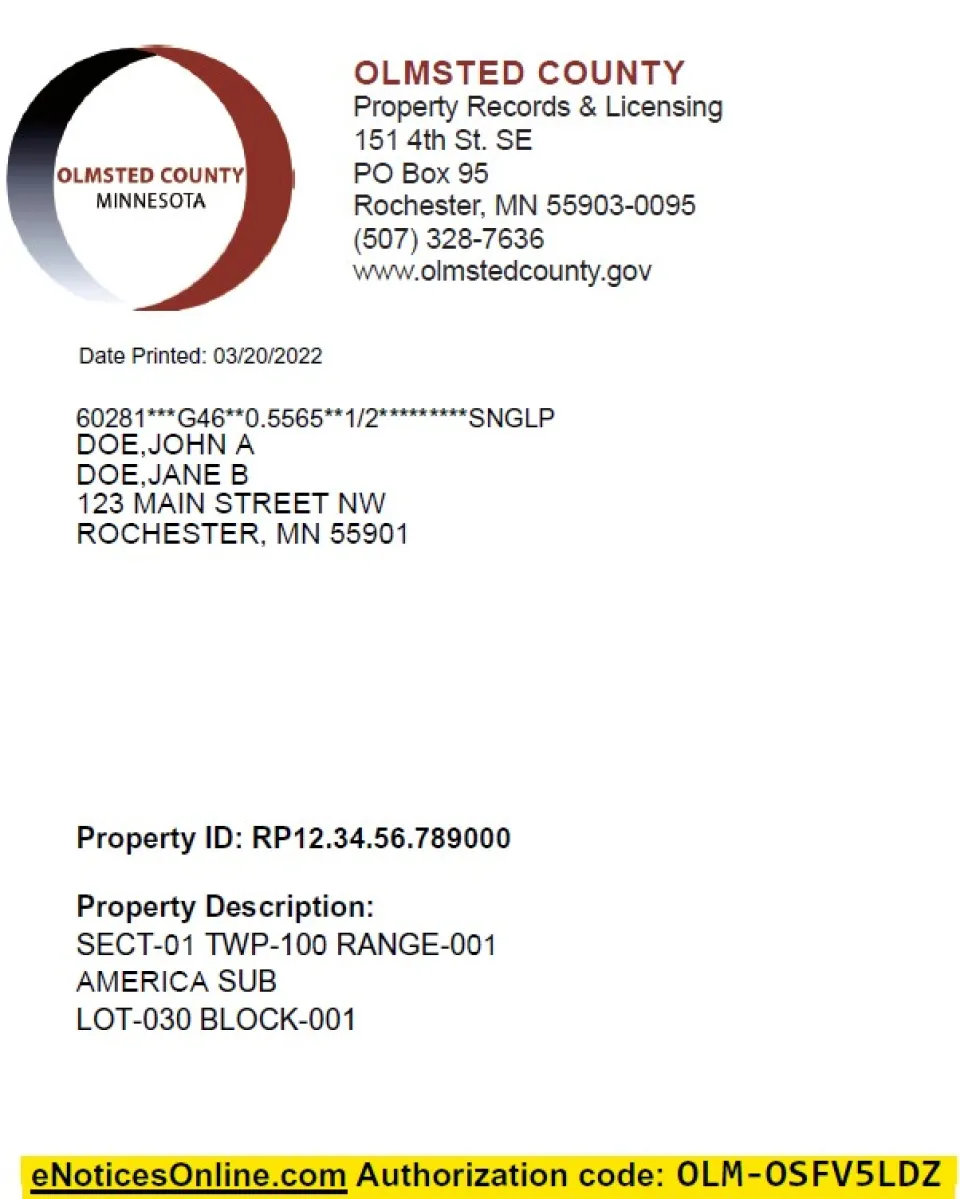

Find the eNoticesOnline Authorization Code printed on your Tax Statement; Truth in Taxation notice; or Valuation Notice as shown below. Your Authorization code is the same on all of these notices

Once you have your authorization code, follow the link to eNoticesOnline.com, click on the "Create New Account" link at the top of the page, and follow the steps. Approximately 24-48 hours after you have verified your account, you will receive an email indicating that your bills/statements are available for viewing.

Do I have to renew every year?

No. Once you sign up, you will always receive your Tax Statement and Valuation Notice electronically, and will no longer receive a paper copy in the mail. However, if you change your email address, you will need to make sure to update your eNoticesOnline account with the change. If an email address is no longer valid when it comes time to mail out notices, that account will revert to receiving a paper copy again.

What if I own multiple parcels? Can I add them under one account?

Yes. Just add the additional eNoticesOnline Authorization Codes to your current account, then statements and notices for all parcels will be viewable under the main account.

Can I pay my taxes through eNoticesOnline?

Yes. When you sign-in to your account to view your Tax Statement, there will be a "Pay" button that links directly to the Olmsted County Property Tax portal where you will be able to pay taxes by credit card or e-check.

What if I sign up and decide I don't like it?

Just cancel your eNoticesOnline account and you will begin to receive paper copies again during the next mailing.

Important Dates for Property Taxes

| Date | Event |

|---|---|

| February 1 |

Exempt Property applications due. |

| Mid-March |

Valuation Notices mailed to property owners. |

|

Mid-March |

Real Property Tax Statements mailed to property owners. |

| Mid-April |

Local Board of Appeal Meetings start. |

| April 30 |

Tax Court Appeal deadline. |

| May 1 |

Green Acres applications due. |

| May 15 |

First half Real Estate taxes due. |

| Mid-June |

County Board of Appeal and Equalization Meeting |

| August 31 |

First half Manufacture Home property taxes due. |

| October 15 |

Second half Real Property taxes due. |

| November 15 |

Second half Agricultural and Manufactured Homes property taxes due. |

| December 15 |

Homestead applications due. |

| December 15 |

Actively Engaged in Farming applications due. |